Research that identifies critical user insights

57 opportunities identified with continuous research activities over a two-year period.

An average of 12 users participating in solution validation every sprint over 2 years.

Details

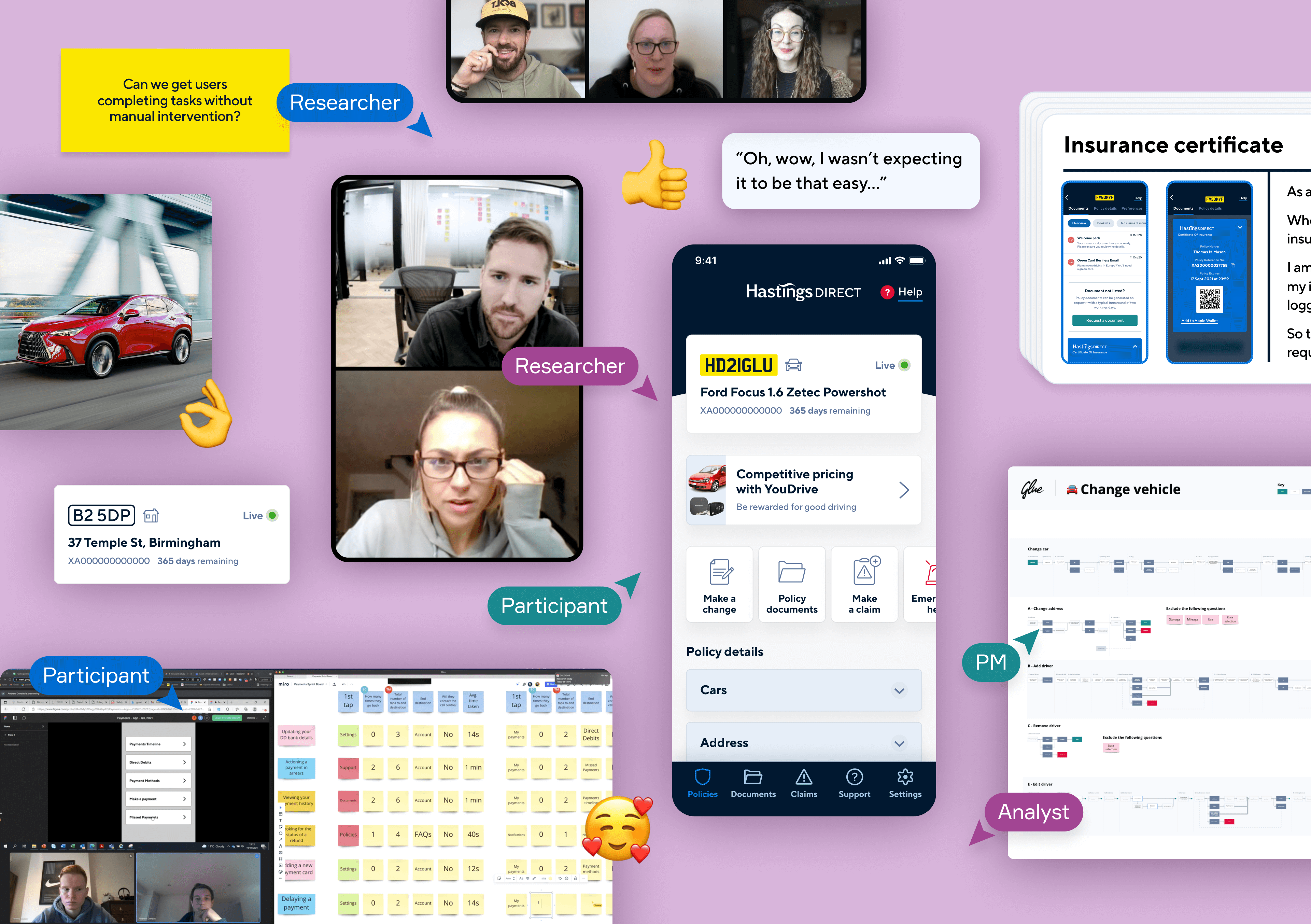

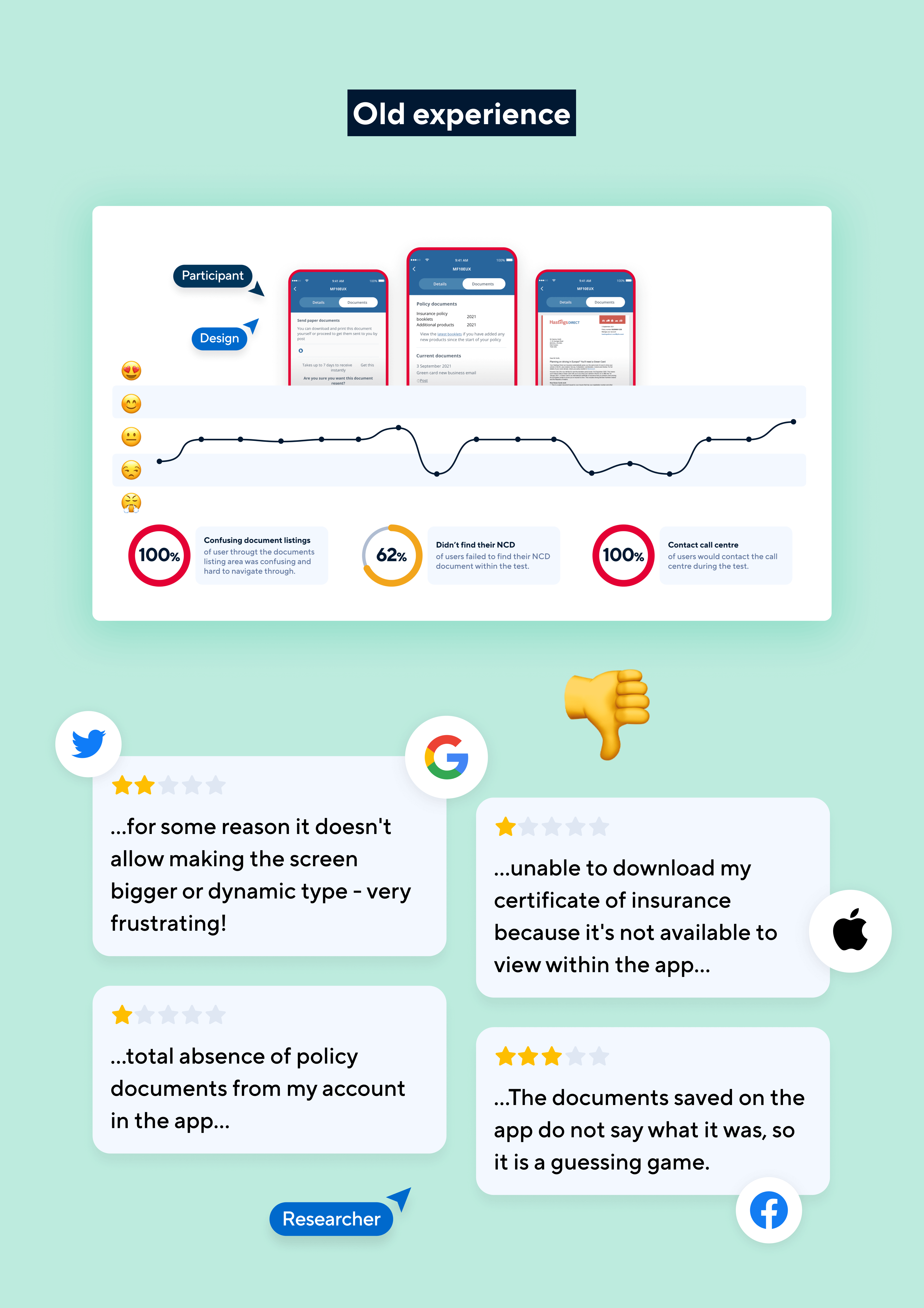

Working alongside Hastings Direct, one of the UK's leading motor and home insurance providers, we conducted a series of comprehensive Research Studies to enhance customer and user experience. Our journey with them involved qualitative, quantitative, and holistic data methods, delivering critical insights into customer-specific expectations and behaviours.

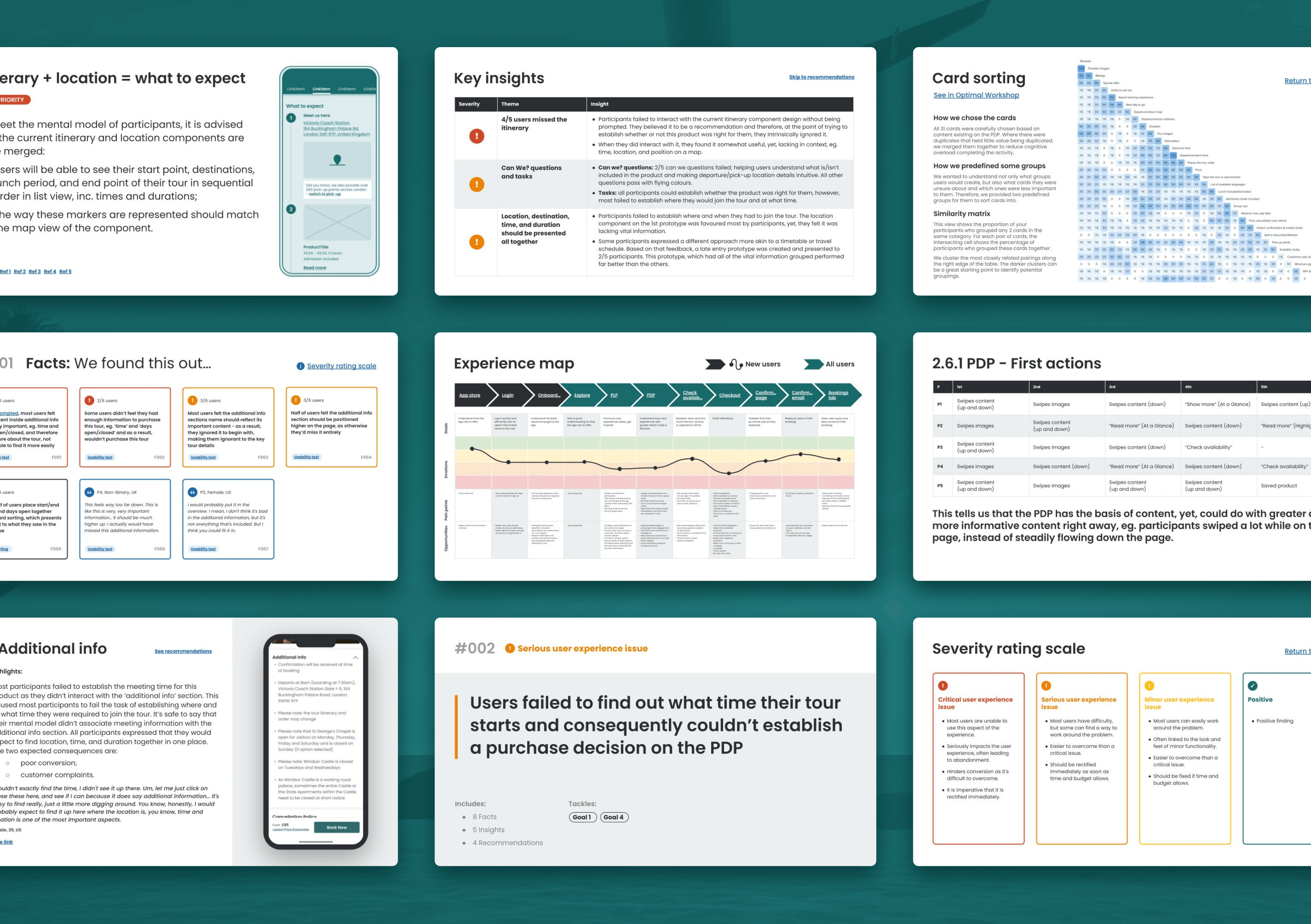

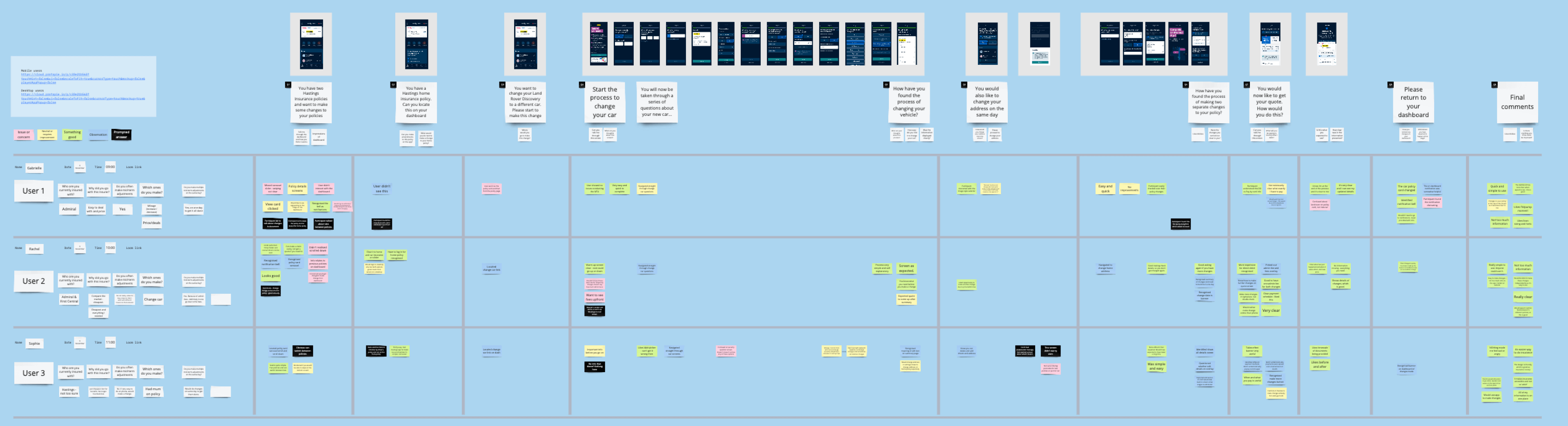

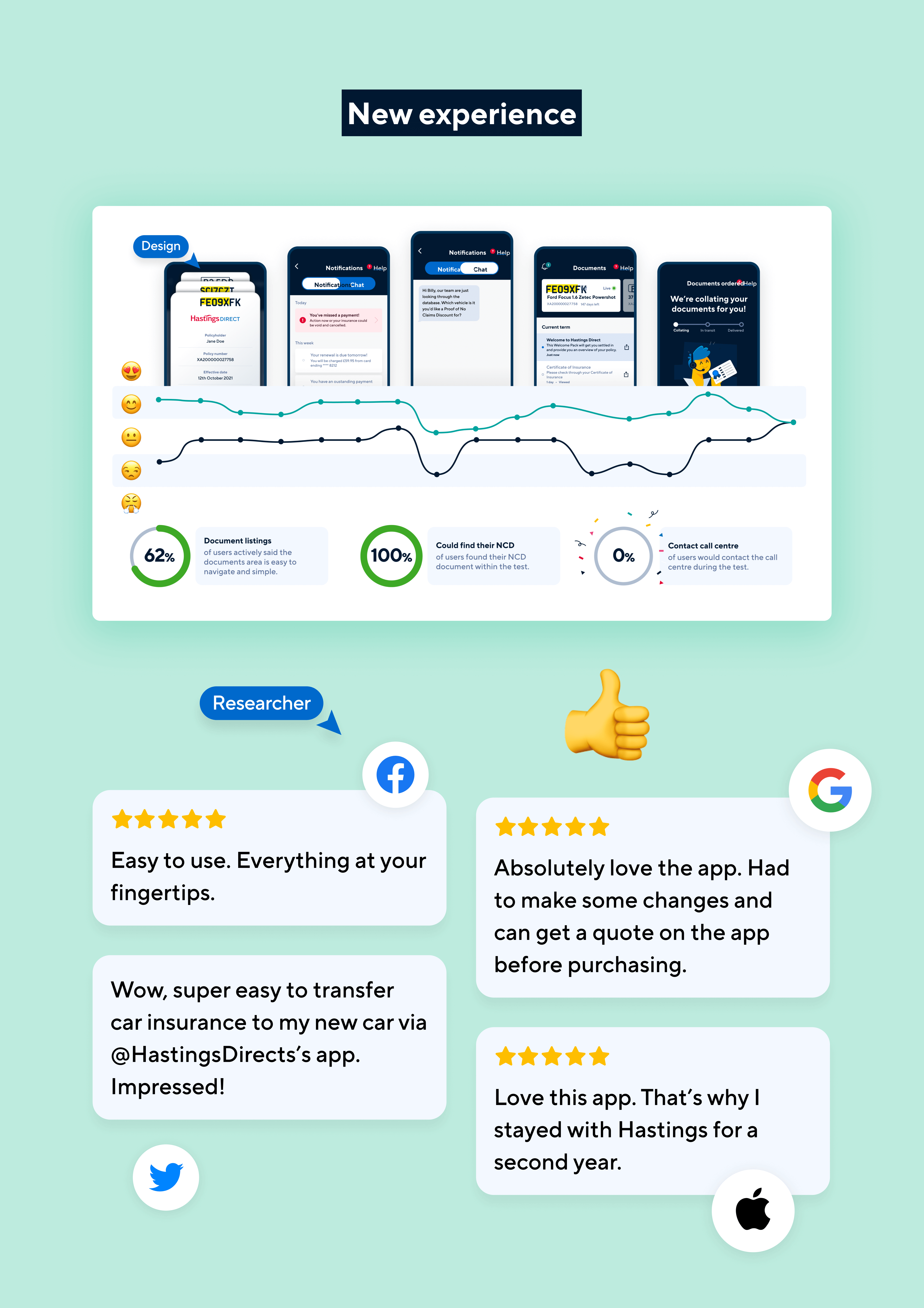

Our research process involved various proven techniques such as card sorting, tree testing, and user interviews, effectively identifying potential bottlenecks and areas for optimisation. These findings helped us craft solutions that improved functionality, increased self-service outcomes, and reduced the dependency on call centres.

Using the 'Atomic Research Framework', we created impactful artefacts like customer journey maps, empathy maps, user flows, and UX/UI recommendations. These have significantly reduced the 'learn, churn, and pivot' cycle for Hastings Direct, driving more efficient, data-informed decisions and ensuring their offerings remain aligned with market needs. Our work has enabled them to deliver a seamless, intuitive, and customer-centric digital experience, reaffirming their position as the UK's best digital insurer.

Other Hastings Direct engagements

you may also like…

- 1-month to deliver

- Built for optimisation

- 1-month to deliver

- Built for optimisation

- 1-month to deliver

- Built for optimisation

- 1-month to deliver

- Built for optimisation

Hastings Direct

Delivering a scalable digital design system

- Validated with 947 participants

- 8 quantitative and qualitative methods

- 59 core journey changes recommended

- Validated with 947 participants

- 8 quantitative and qualitative methods

- 59 core journey changes recommended

- Validated with 947 participants

- 8 quantitative and qualitative methods

- 59 core journey changes recommended

- Validated with 947 participants

- 8 quantitative and qualitative methods

- 59 core journey changes recommended

Hastings Direct

Making a telephony proposition digital