Making a telephony proposition digital

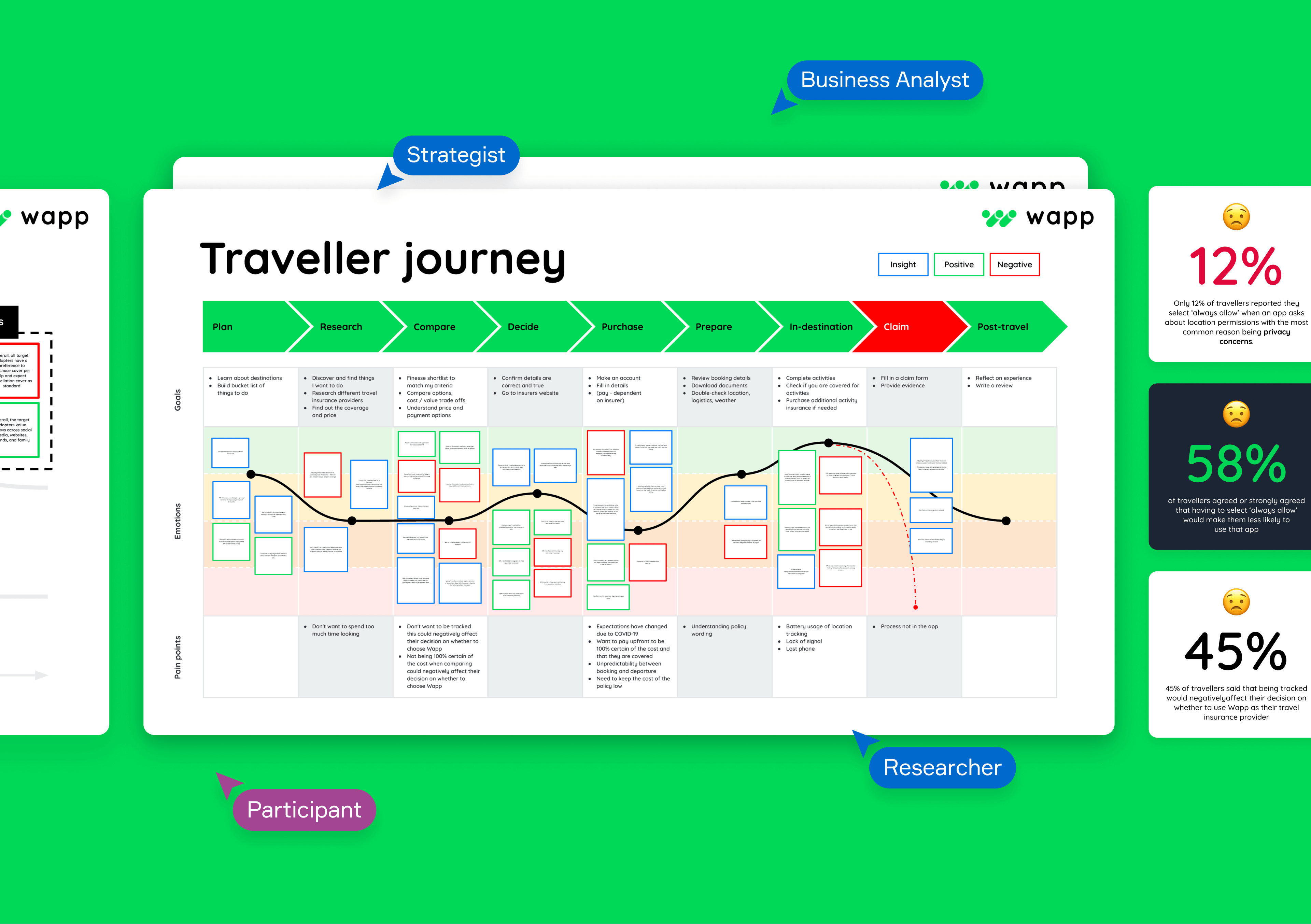

We validated the proposition with 947 Hastings Direct customers over a 6-week period using a mixed methodology approach (quantitative, qualitative, and holistic).

A combination of quantitative and qualitative methods, including customer interviews, voice of the customer, card sorting, and surveys were used to validate the proposition.

By completing the value proposition validation, we uncovered and identified 59 recommended improvements across channels and digital products.

Details

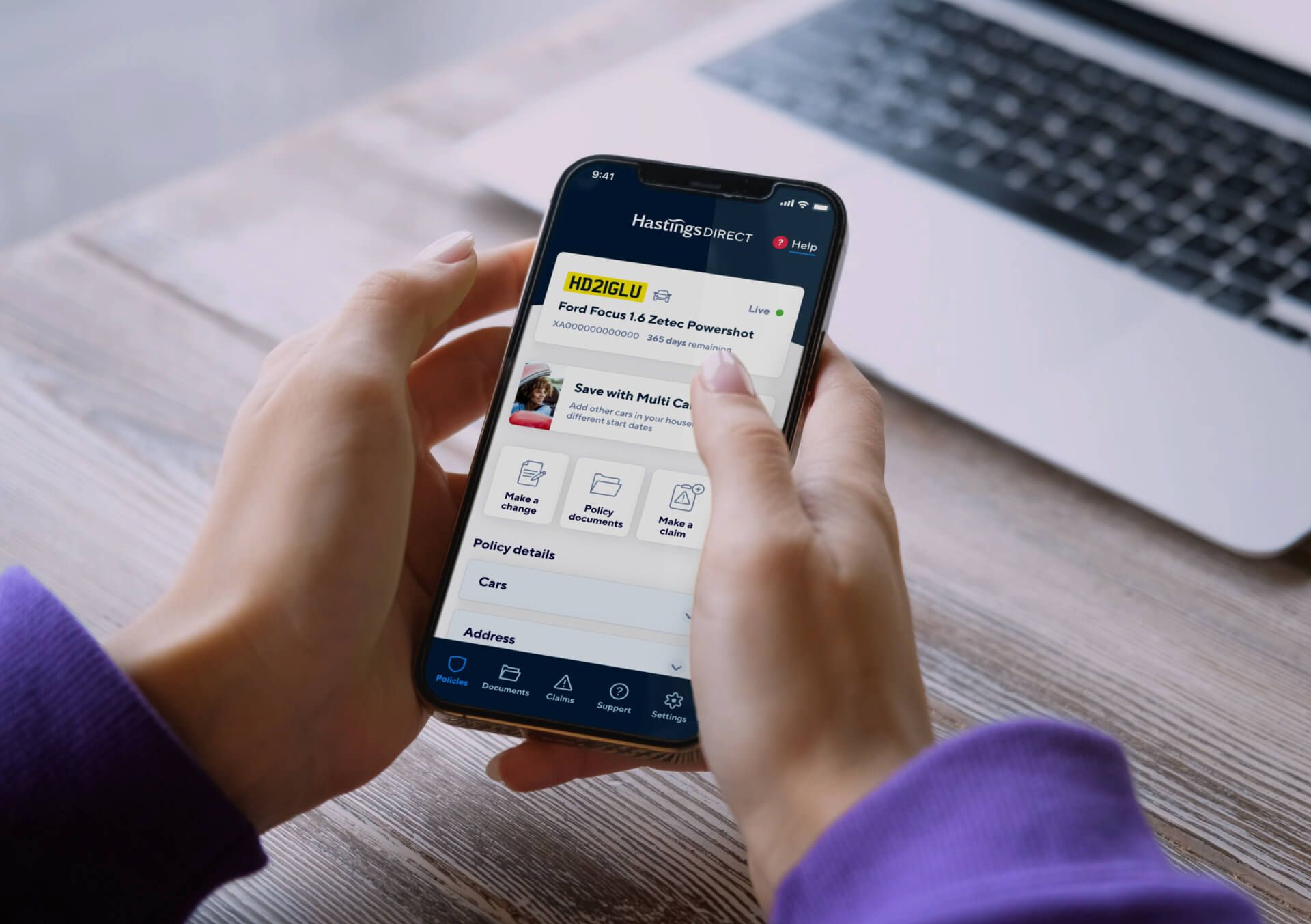

In the ever-evolving insurance landscape, we partnered with Hastings Direct, a leading UK insurance provider, to validate and refine a ground-breaking proposition for their car insurance retention process. To validate this proposition, we engaged 947 customers with eight diverse research methods, delivering an amalgam of qualitative and quantitative insights over an eight-week period.

Our research revealed key insights into customer behaviour and their decision-making process. Primarily, we discovered that price, flexibility and transparency were vital customer focus areas during the decision-making process.

By leveraging these insights, we formulated comprehensive recommendations to refine the proposition, offering customers a digital turn-key solution that addressed their specific needs and matched their online buyer behaviours.

Our compelling work with Hastings Direct underscores the power of strategic Proposition Validation in driving digital adoption and customer satisfaction. By honing in on customers' needs and specific pain points, we laid the groundwork for Hastings Direct to implement an optimised product journey that delivered value and transparency. Our partnership has elevated Hastings Direct's digital presence, reinforcing its position as the UK's top digital insurance provider while fortifying its long-term goal of reducing call centre dependency.

You may also like our other

Hastings Direct engagements…

- 1-month to deliver

- Built for optimisation

- 1-month to deliver

- Built for optimisation

- 1-month to deliver

- Built for optimisation

- 1-month to deliver

- Built for optimisation

Hastings Direct

Delivering a scalable digital design system

- 2.5 year relationship

- 3 core journeys

- 1000+ participants & customers contributing to testing

- 2.5 year relationship

- 3 core journeys

- 1000+ participants & customers contributing to testing

- 2.5 year relationship

- 3 core journeys

- 1000+ participants & customers contributing to testing

- 2.5 year relationship

- 3 core journeys

- 1000+ participants & customers contributing to testing

Hastings Direct

Digital transformation for the UK’s biggest digital insurer