- Home

- Industries

- Transforming The Insurance Industry

Transforming the

Insurance industry

As the industry continues to evolve and the transition to a ‘digital first’ future gathers pace, getting to grips with the practical influences and models that allow businesses to deliver effective and successful transformation has never been more critical.

Our research shows that the leading digital insurers take a holistic approach to operational transformation, considering how data, internal culture and delivery methods combine to drive long-lasting change and commercially aligned growth.

Our frameworks and tools are designed to help you confidently move forward by focusing on the essential principles required for cultural change and digital adoption. Each framework is designed to build process-oriented, data-backed validation and delivery practices that empower internal teams to deliver with predictably and consistency.

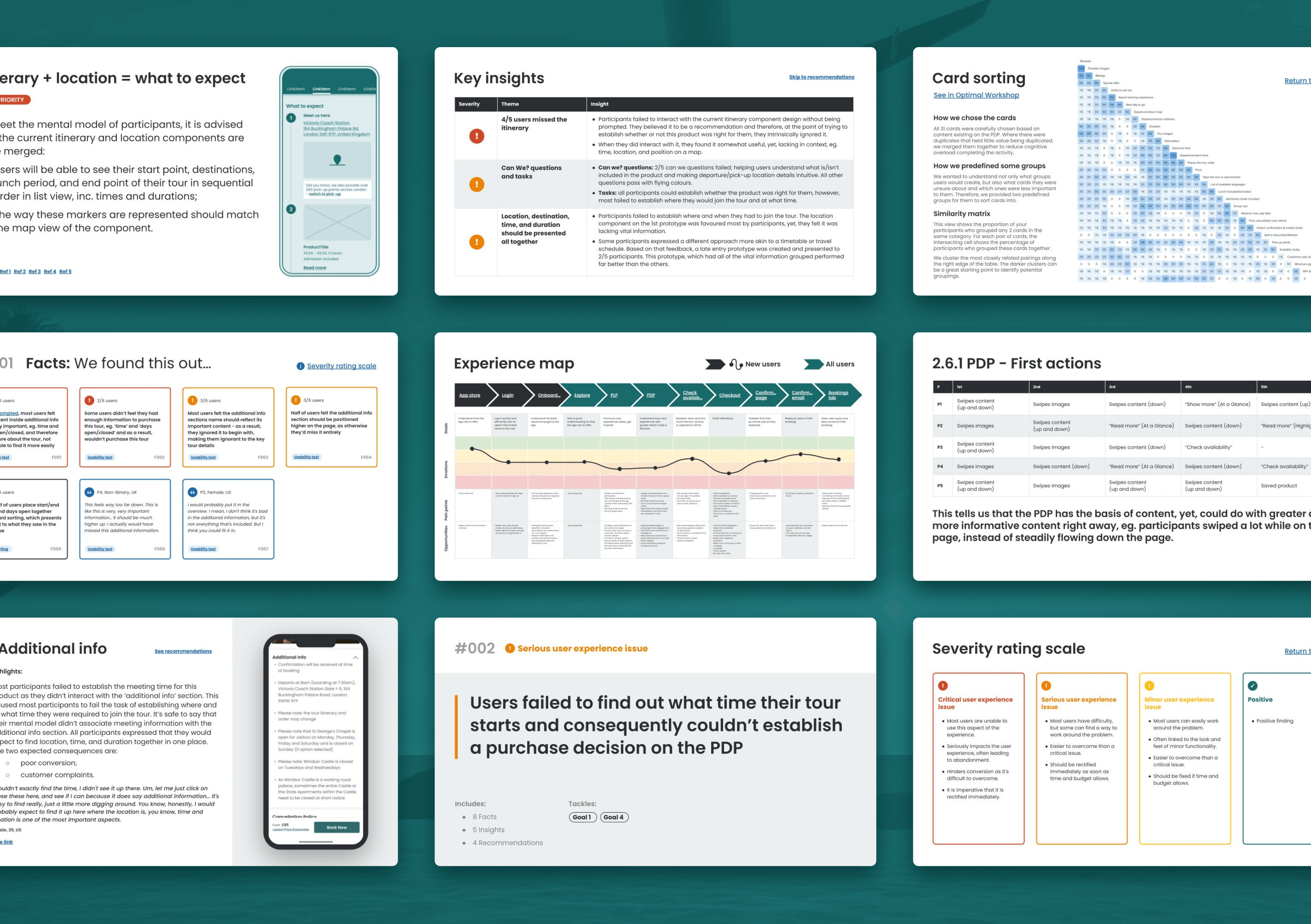

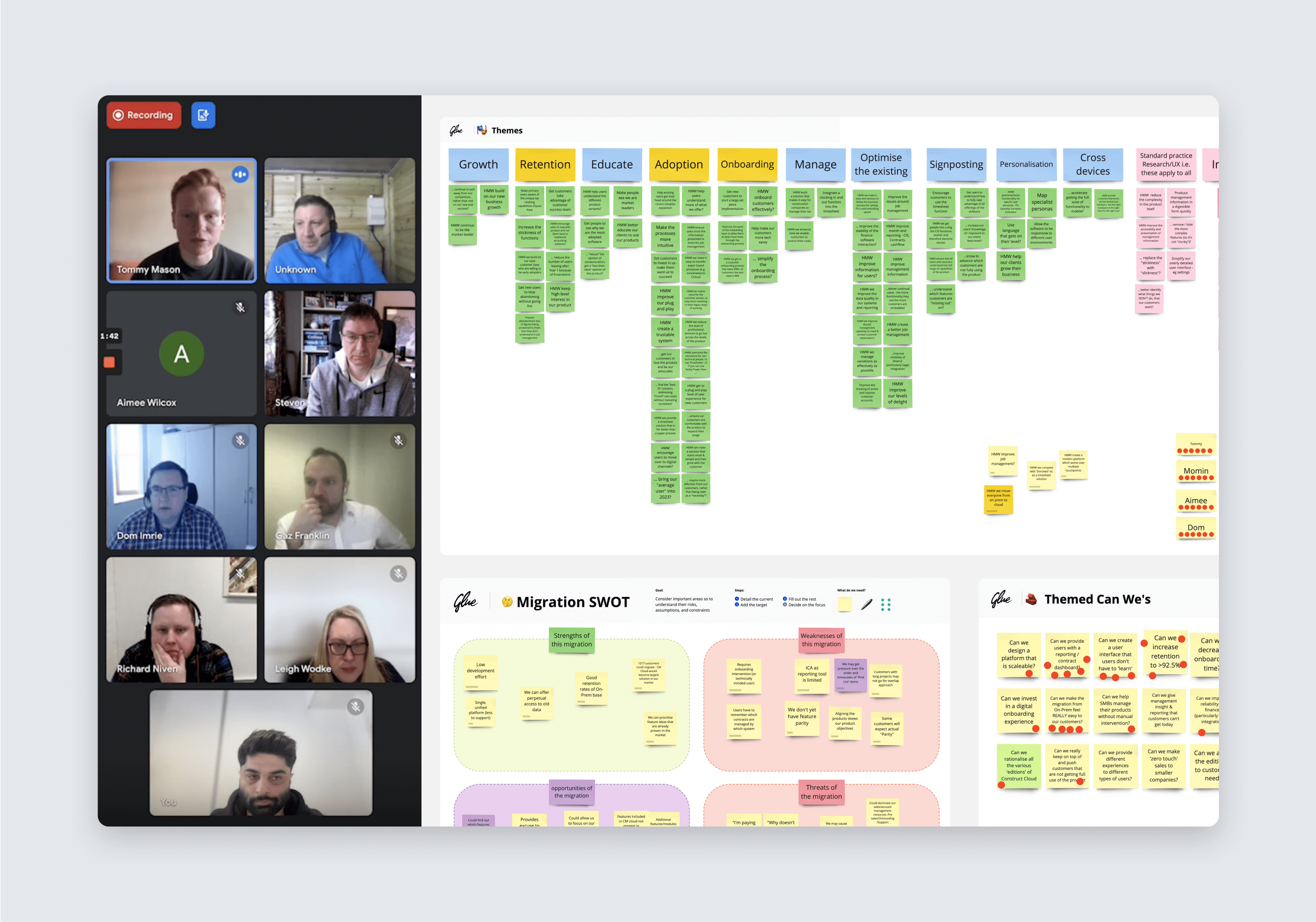

Research and validation

By conducting deep market research, they shape and validate their strategies to resonate with customer dynamics and align with the evolving market landscape.

Informed

decision-making

Using various data sources to validate and fine-tune commercial and product strategies, they ensure their decisions are based on relevant and accurate insights.

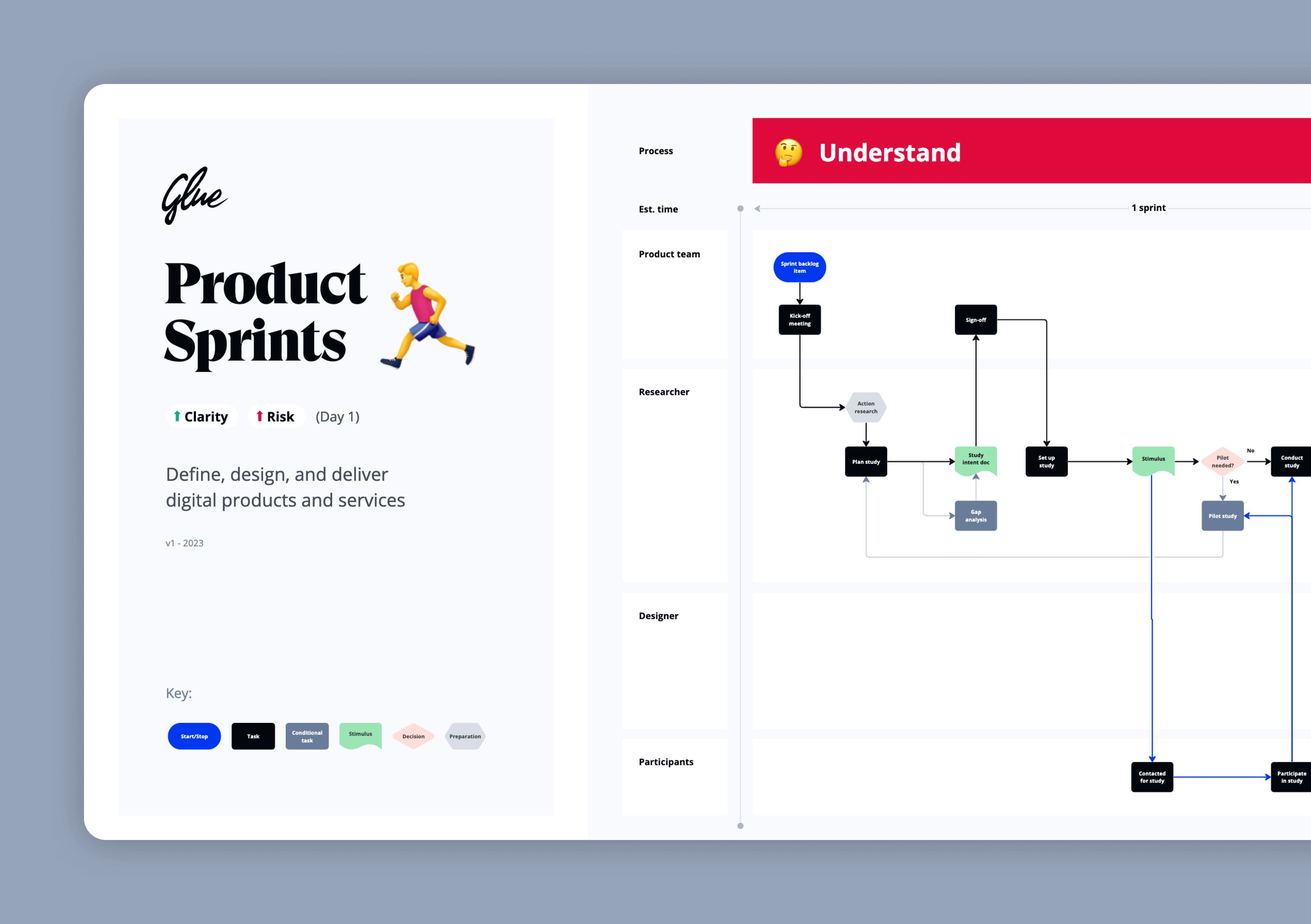

Predictable

and efficient

They deliver rapid solutions and responses tailored to enhance outcome predictability, enabling efficient planning and resource allocation.

We equip digital-first leaders to address the most pressing industry challenges, from redefining policy pricing strategies to enhancing customer experiences in innovative ways.

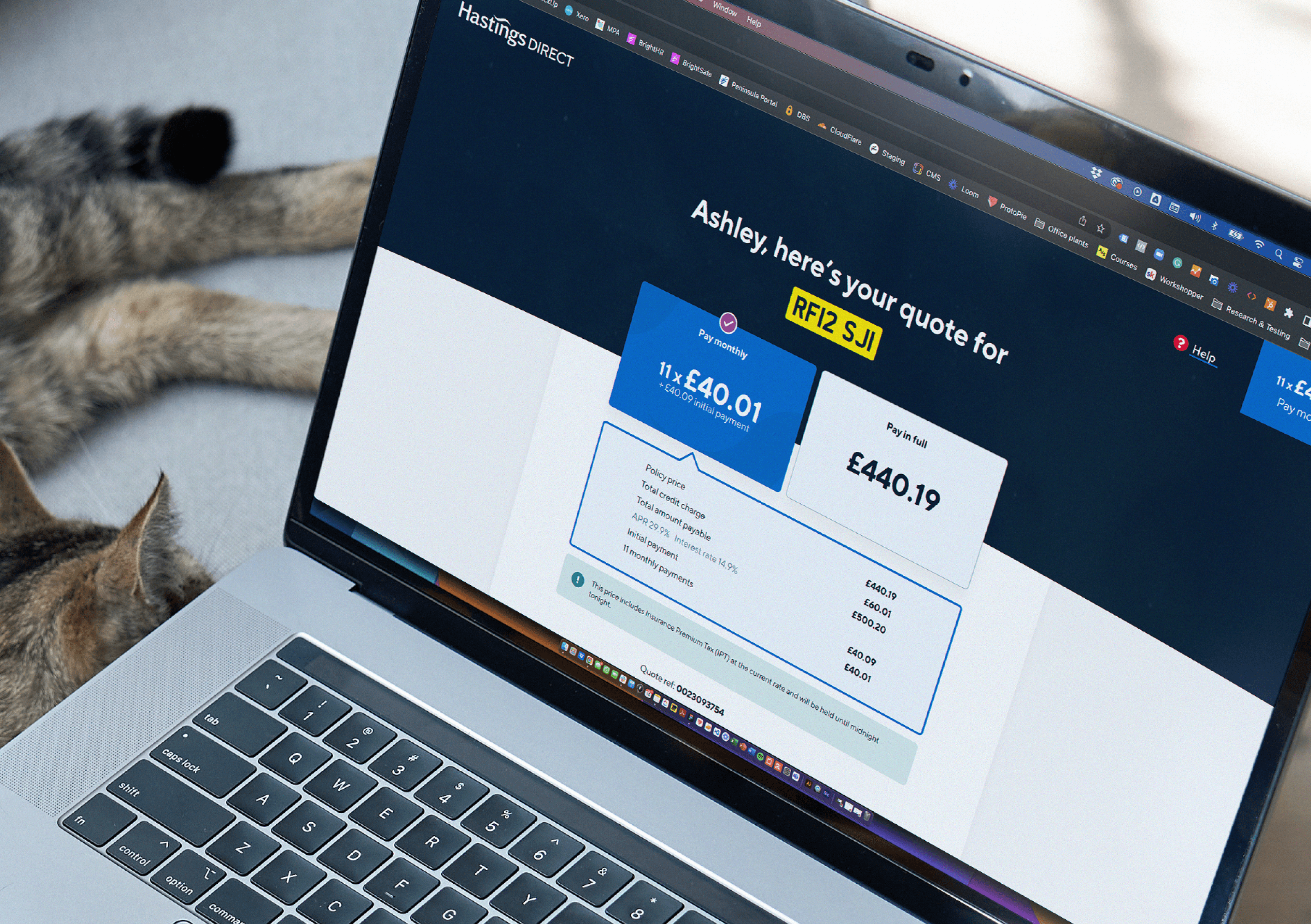

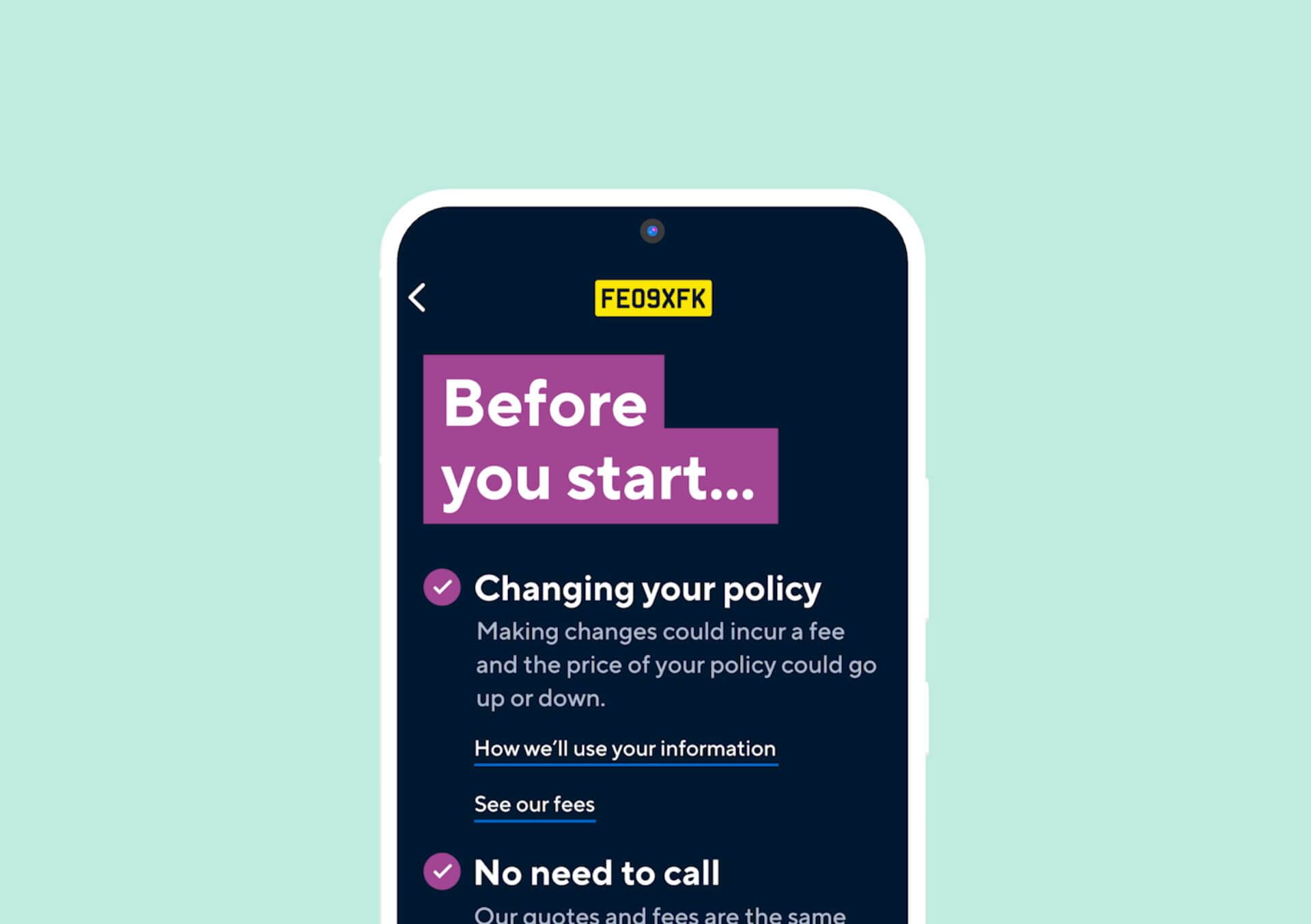

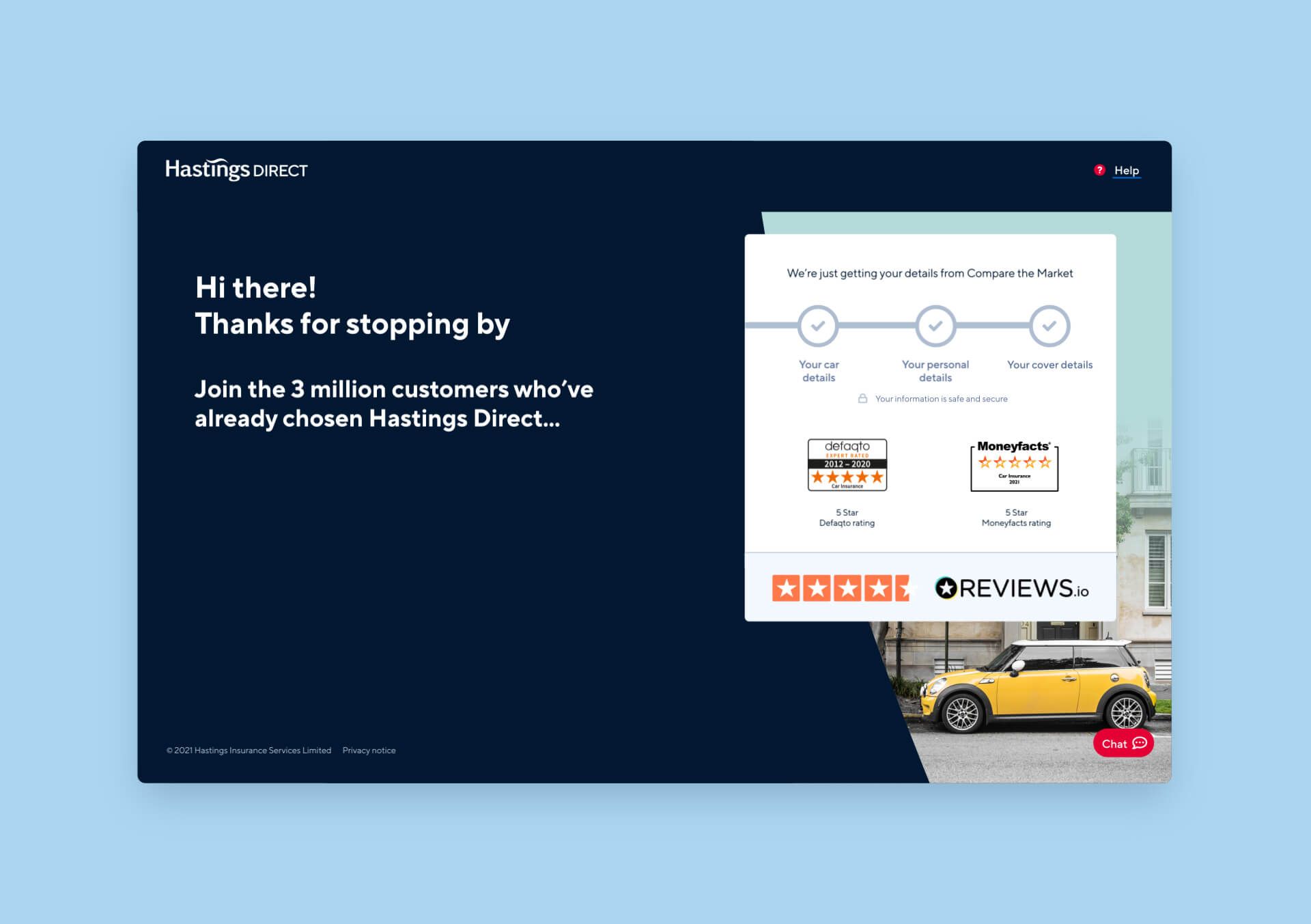

We helped the UK’s biggest digital insurer, Hastings Direct, with Digital transformation

Hastings Direct sought to improve its digital presence and customer experience across multiple channels. Specific focus on enhancing customer acquisition from PCWs and mobile app experience to reduce call centre contacts, accelerate digital adoption, and increase lifetime customer value.

- Positive impact on Income Per Policy

- Increased sales coverage of Ancillaries

- Extended Policy Lifetime Value

By supporting teams with capacity and/or empowering capability, we effectively improve the key metrics digital-first insurance leaders use:

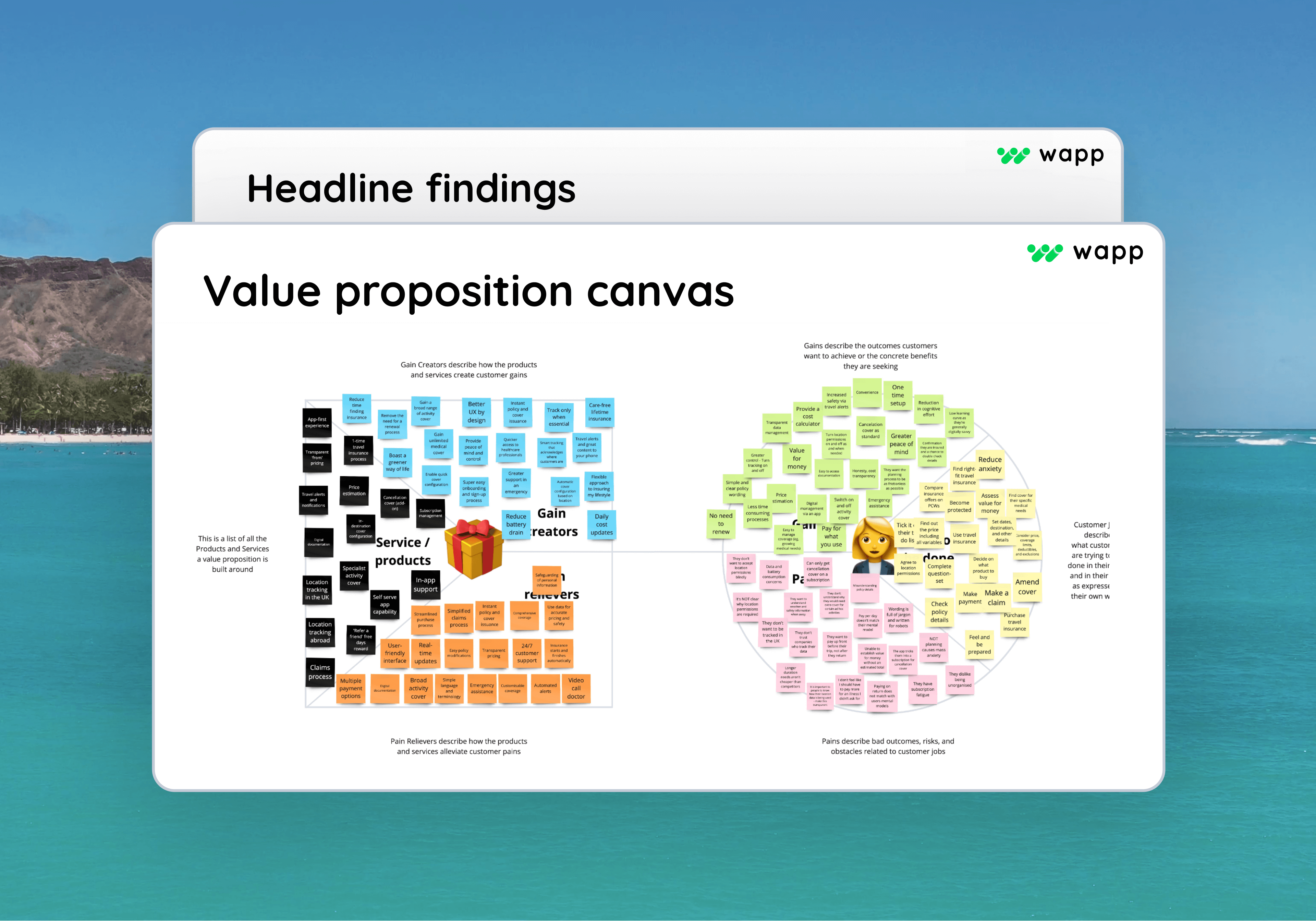

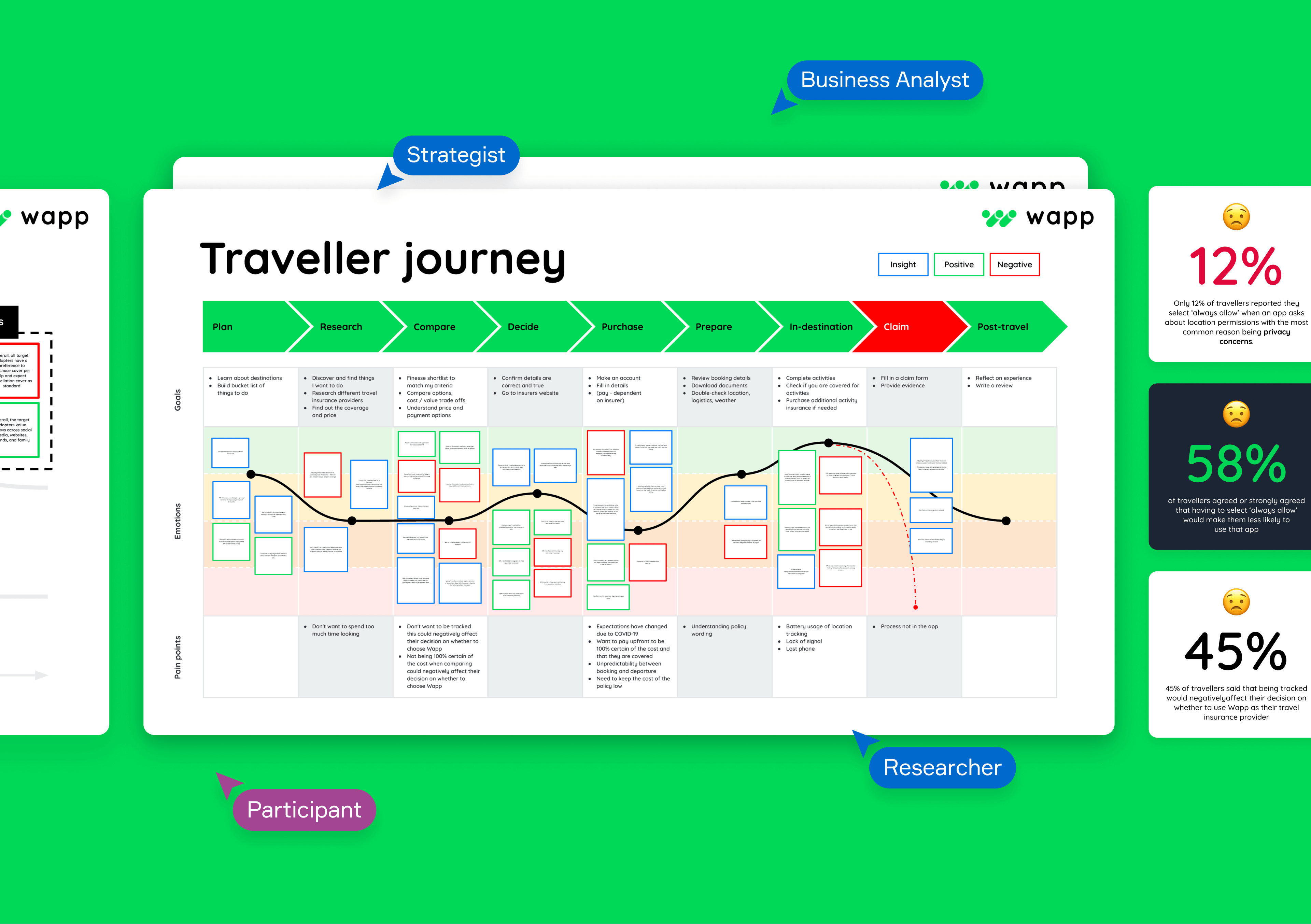

We validated Wapp's travel insurance proposition, finding ways to improve it

We deployed our Proposition Validation framework for Wapp, delving deep into traveller's motivations, needs, and concerns. Our in-depth analysis revealed crucial insights into customer sentiments towards Wapp's service. As a cornerstone of data-driven decision-making, our findings provide a clear roadmap for Wapp to enhance its proposition.

- Validated with 4,499 travellers

- 7 areas identified for improvement

- Delivered in 6-weeks

As the industry transitions, it has to embrace new ways of thinking, driving organisational improvements that provide the foundation for a deeper understanding of customers' wants and needs and how best to serve them in the future. Put yourself at the forefront of the insurance revolution: it’s happening whether you’re ready or not!

Interested in learning more? Get in touch to find out how we can support you.